What Is Sustainable Finance?

Sustainable finance is a financial idea concerning the management of environmental, social, and governance (ESG) factors in investment financial decisions. Finance can be sustainable for society itself. Loads of money count, but so do humans-good and bad-and ecosystems. This includes climate change, extinction, pollution reduction, CSRs, labors, human rights, and how we govern.

Read Latest Fintech Blog: The Future of Digital Wallets and Payment Systems for the Unbanked

The Importance Of Financial Inclusion

On the other hand, financial inclusion means that everyone has access to efficient and affordable financial services. It also means impoverished education and inclusion at different levels of participation. Women, co-ethnicities, low-income populations, and underprivileged are potentials. It promotes economic and civic participation, poverty reduction, and economic development. Financial Empowerment can be achieved. Some 1.7 billion global adults currently remain unbanked, with the majority in developing countries. Services of financial inclusion give everyone access to finance, and it makes a fine overall economic health plus reduction of economic inequality.

Key Statistics On Sustainable Finance And Financial Inclusion

- 1.7 billion adults remain unbanked globally (World Bank).

- Global green bond issuance exceeded $500 billion in 2022 (Climate Bonds Initiative).

- The global impact investing market surpassed $1 trillion in assets under management (Global Impact Investing Network).

- Over 3 million social enterprises generate more than $4.5 trillion in revenue ( McKinsey & Company).

- According to the International Finance Corporation (IFC), $5 trillion in annual investments is needed to achieve the UN’s Sustainable Development Goals (SDGs) by 2030.

Read Latest Fintech Blog: DeFi (Decentralized Finance) as a Tool for Financial Inclusion

Key Components Of Sustainable Finance

- Green Equities: Green equities are defined as companies or funds directing investments that have largely positive environmental consequences. Such include:

Green companies: Investments in companies possessing a clear strategy of advancing renewable energy or electric vehicle technologies.

Green funds: Mutual and exchange-traded funds focusing on companies with a good environmental footprint; like Carbon Leaders.

- Green Debt: Green debt instruments are designed to finance projects with respect to climate change and sustainability trail.

Green and sustainable bonds: These are issued to finance projects with a clear environmental intention, such as energy-efficient building renovations.

Sustainability-linked bonds: These bonds relate bond proceeds to the issuer’s sustainable goals, such as renewable energy infrastructure.

Green and sustainable loans: Loans aimed at financing environmentally beneficial services and products, such as energy-saving home improvements.

These financial instruments provide the initial capital to kick-start the green economy while creating financial opportunities for the marginally included.

Read: Fintech and Microfinance: Bridging the Gap for SMEs

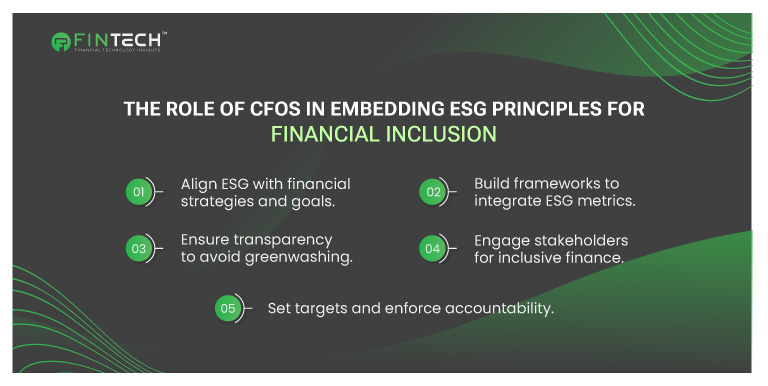

The Role Of CFOs In Embedding ESG Principles For Financial Inclusion

CFOs’ representatives are very critical in growing the integration of ESG into their organization’s financial strategies of certain jurisdictions. Typically, high-level boards have adopted a passive attitude towards ESG issues, dealing with them only when significant mandates arise through regulations. For real progress, however, the CFO is required to be proactive in integrating ESG into the organization’s strategic objectives. Also, the CFO is most keenly placed to provide direction regarding the flow of capital to sustainable utilization and, henceforth, may play a significant role to ensure financial concretization.

- Integrating ESG in Organizational Strategy: CFOs should integrate ESG issues into pricing and business strategy by defining clear sustainability goals through comparing ESG data insights to capital investment decisions. CFOs can further develop sustainable finance frameworks that describe KPIs and allow organizations to measure and monitor ESG performance progress.

- Development of Sustainable Finance Frameworks: Putting in place a structural approach to incorporating ESG into financial decisions requires, setting priorities for the relevant metrics that include ESG, defining goals and targets, and persistent engagement in performance assessment of sustainability. The CFO should help align corporate financial strategies and sustainable development objectives—identify synergies along functions and push the delivery of positive outcomes.

- The Mitigation of Greenwashing Risk: It’s imperative that CFOs avoid instances of greenwashing, where one makes exaggerated claims of a company about its environmental endeavors. In theory, a case of greenwashing would dilute credibility in ESG initiatives and lead to risks regarding their trustworthy conveyance into the marketplace. Such fears can be real, breaking into perhaps legal suits or causing reputational damage. CFOs will do well by leaning toward ensuring the authenticity and measurability of the company’s sustainable efforts, following the industry standards and best practices to mitigate potential Greenwashing risk.

- Stakeholder Engagement: Stakeholder engagement, further among investors, regulators, communities, and policymakers, is crucial for developing financial inclusion strategies that are inclusive and fair. CFOs should ensure that ESG considerations will penetrate and reflect the company-centric decisions: all financial products accessible to everybody, especially people who are economically marginalized.

- Setting Clear Targets and Making CEO Accountability: To get sustainable finance actions to generate the desired outcome, CFOs will set exact goals and performance indicators to monitor progress using credible ESG data. With this transparent and standardized approach in place, CFOs can hold organizations accountable to their commitments toward sustainable finance, including addressing risks originating from greenwashing.

Social Implications Of Climate Financing

Climate financing must take social factors into consideration since other aspects may also suffer. For instance, the divestment from “brown” asset – fossil fuel-based industries or implementation of strategies aimed at lower emissions-selectively impacts communities dependent on these industries for jobs. CFOs must involve stakeholders, policy-makers, and local communities to draw on equity-and-fair transition plans with minimal social risks to achieve a fair and just transition to a green economy.

It’s crucial to balance the environmental (E), as well as the social (S), aspects of ESG. For instance, the transition to renewable energy could accomplish high environmental targets but that could seriously threaten social consequences if social inclusivity is not executed. CFOs must ensure the policies are balanced and anticipate any long-term social implications arising from any financial decisions.

A Strong Transition Plan With Upskilling

As the organizations begin making headway toward sustainability, CFOs will drive the development of strong transition plans across the organization and the entire value chain. This includes uniting strategies, processes, and systems toward sustainability objectives that impact various stakeholders while fostering cross-functional collaboration. Corporate finance must also recognize the need for upskilling within their organizations in order for these plans to be put into effect.

- Transition Plans: CFOs should support the development of integrated transition plans that align with sustainability goals and seek to lead the transition toward sustainability within the business itself and the wider supply chain. Plans must be inclusive, taking cognizance of all stakeholder needs, in order to ensure a smooth transition to a sustainable future.

- Upskilling: Ongoing training on ESG principles and emerging regulations is critical to ensure that financial personnel and other critical areas are equipped to work in sustainable finance frameworks. CFOs must invest in upskilling so employees know and can execute the company’s sustainability strategy.

Sustainability Incentives And Carbon Pricing

Organizations should put in place incentive systems to encourage alignment with ESG outcomes. By linking compensation to sustainability targets set by the organization, CFOs can help employees focus more on ESG in their everyday work. This can create a culture oriented around sustainability whereby every employee has a part to play in creating positive social and environmental change.

At the same time, CFOs should reflect on the consequences of carbon pricing; the nature of the cost of one ton of carbon can be integrated into emissions cuts. The need to pay attention to emissions needs equally to be balanced by, for example, biodiversity and social justice, which have equal weighting in a full-blown sustainable development agenda.

Conclusion

Sustainable finance is a means by which financial inclusion will flourish and inclusivity in economic development will succeed. With the help of green bonds, impact investing, and social enterprises, amongst other instruments, sustainable finance can close the financing gap where the needs of underserved communities are concerned while tackling some of the broader global challenges posed by climate change and inequality.

CFOs and financial analysts form integral elements for the combination of ESG criteria in terms of fair decision-making possibilities. When CFOs develop and build governance that foresees ESG within their organizations, a fusion of their sustainability and financial objectives becomes evident. Thus assuring that sustainable finance programs will generate all the long-term social and environmental effects required. It is important that CFOs factor in risks such as greenwashing, consult with stakeholders, and analyze the social consequences of climate financing to draft a balanced approach to sustainability. The positive way forward to develop a more sustainable, inclusive, and resilient future lies in very strong leadership, working together, and upskilling for CFOs.

Read: Top 10 FinTech Cybersecurity Challenges in 2025

We will be back with more exciting articles in the fintech domain!

Write to us for any suggestions.