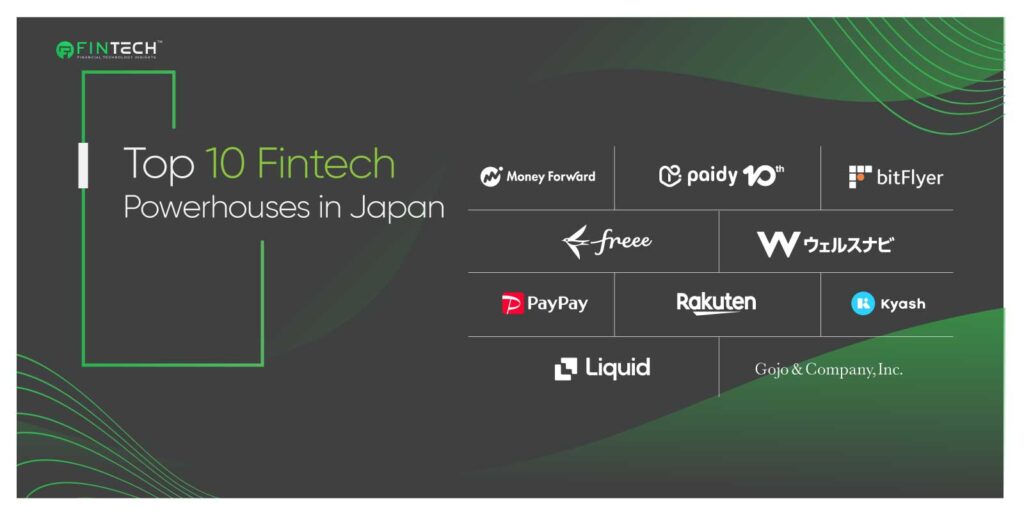

Japan is another country we have picked up for top 10 fintech powerhouse research and writing article for our fintech readers.

In this blog we will be discussing about the top ten fintech powerhouses in the country of Japan. Yes, we have released a special Top 10 fintech powerhouse series for financialtechnologyinsights.com whereby we will make our readers aware of the top fintech powerhouses around the world.

Let’s see!

Read latest: Top 10 Fintech Powerhouses for Banking and Insurance

Money Forward offers a comprehensive personal financial management platform, providing services such as budgeting tools, expense tracking, and financial planning. It has become a widely used tool for individuals seeking to manage their finances effectively. citeturn0search7

Established in March 2008 as Exchange Corporation Co., Ltd., the principal business was “AQUSH” social financing. After launching “Paidy” in October 2014, progressively switched the business focus to “Paidy” and closed new recruiting in June 2018.Paidy payments on numerous sites will be consolidated into one, and the billed amount will be sent and SMSed to the registered mobile phone by the 3rd of the following month. User pays bill by bank transfer or convenience store by 10th. The payment method will determine the remittance fee. Direct debit can also be automated. The April 2020 introduction of “Paidy Plus” includes identity verification and usage restriction setting.

Read: Automating Know-Your-Customer (KYC) and Anti-Money Laundering (AML) Processes

Former Goldman Sachs derivatives and bonds trader Yuzo Kano created bitFlyer in 2014.bitFlyer’s cryptocurrency exchange debuted in April 2014, several months before Mt. Gox’s collapse. When Japanese officials accused the exchange of failing to prevent money laundering and terrorism, it stopped accepting new users in 2018.Regulations said most directors were buddies of CEO Yuzo Kano, a veteran Goldman Sachs trader.[4] In February 2016, it had 100,000 customers and processed 7 billion yen ($64 million USD) in monthly cryptocurrency transactions, making it Japan’s largest Bitcoin exchange. Through three venture capital rounds, it raised $36 million USD.The startup partnered with retailers, mobile app developers, and payment processors to enable smartphone-based bitcoin payments at stores.Regulations allowed bitFlyer to sell cryptocurrency to institutional investors. Internationally, bitFlyer extended to the US in November 2017 and Europe in January 2018.By 2018, it processed 80% of Japanese bitcoin transactions and had 150 employees.BitFlyer was one of six exchanges required to enhance money laundering processes in 2018, suspending services while it developed new systems. BitFlyer established a blockchain subsidiary in 2019. BitFlyer was penalized by the NYDFS in May 2023 for failing to meet state cybersecurity rules.The firm was fined $1.2M.

freee pushes boundaries and defies conventions. Freee leads organizational strategy, operations, finance, and HR and will shape the future.freee strives to give the greatest service and set a global standard for value. Through worldwide investor funding, freee will strengthen its products and services and grow from their perspective.Freee, the pioneer of cloud-native, integrated ERP software for SMBs, is co-founded and led by Dice. Free growth is only possible for members. Freee strives to help each member, who has endless potential, become a “new me”.

Read: Fraud and Financial Crime: The Role of Collaboration Between Banks and Fintechs

Wealthnavi is located in Tokyo, Tokyo, Japan.Wealthnavi automates investment transactions and asset balance adjustments.Risk is reduced by investing in global equities, bonds, gold, and real estate. Users can simply benefit from the new NISA tax-exemption system with NISA Account Support. This simulation uses WealthNavi’s investing model to predict future asset prices under specific risk and return assumptions. The process to open an account is completed online in a few steps, starting with a free diagnostic of the optimal investment plan. Partnership programs provide advantages including preferential programs and mileage/point accumulation.

Japanese company PayPay Corporation (PayPay株式会社) is owned by LY Corporation and develops electronic payment systems. Through Z Holdings, SoftBank Group and Yahoo Japan formed it in 2018.PayPay is the leading Japanese mobile payment app with 38 million users.Paytm, an Indian payment service firm, helped it launch a QR code and bar code payment service in October 2018. Users link their bank account and fund PayPay with a smartphone app.

The Tokyo-based technology company Rakuten Group, Inc. was formed in 1997 by Hiroshi Mikitani. Based on the online shopping platform Rakuten Ichiba, its activities include Fintech-based financial services, digital content and communications services including Viber, Kobo, and Rakuten Mobile, Japan’s fourth-largest mobile carrier. As of 2021, Rakuten has over 28,000 employees in 30 countries and regions and $12.8 billion in revenues.[4] Rakuten sponsored FC Barcelona from 2017 until 2022 and the NBA’s Golden State Warriors since 2022. Sometimes called the “Amazon of Japan”

Read: Document Automation for Loan Origination: Reducing Fraud in Credit Risk Assessment

This is a Tokyo based company which was formed in 2015. This company is dedicated to the development of the next-gen money exchange infrastructure. The organization aims to transform the Japanese financial domain by providing mobile payment and banking services to clients and a financial platform to businesses.Kyash is a mobile banking application that provides users with the ability to make payments, transfer funds with just a click on their phone via an application. The application also provides a digital wallet and prepaid card services.

Liquid establishes a secure cryptocurrency ecosystem that enables consumers and traders to capitalize on the pros of financial independence that blockchain technology provides.Formed a decade back, Liquid serves millions of clients internationally as a cryptocurrency-fiat exchange platform.This company is committed to ensure its clients satisfaction, and prioritizing the resolution of any issues they may have.

Read: Risk-Based Pricing and Fraud Prevention in Digital Lending

Gojo & Company, Inc. invests in and partners with financial service providers worldwide to enable financial inclusion for unserved populations. The Tokyo-based corporation has group companies in 13 Southeast Asian, South Asian, Central Asian & Caucasus, and African nations. Gojo is a group of people and organizations dedicated to global financial inclusion. As a holding company, Gojo raises funds from mission-aligned investors and invests them in group companies to enhance their reach and effect. Gojo works with group firms to build digital financial services for clients, enabling economies of scale and boosting access. Gojo designs prototypes for its clients’ digital financial infrastructure. Gojo aims to empower everyone to transcend their birth circumstances and shape their future. We aim to expand financial inclusion worldwide.

Read: The Ethics of Fraud Detection: Balancing Automation with Consumer Privacy

Read: The Rise of Identity Fraud and How Fintechs Can Combat It

Read:AI-Driven Fraud Prevention: The Next Frontier in Financial Security

To share your insights with the FinTech Newsroom, please write to us at news@intentamplify.com