Fintech: An Overview

The term “fintech” refers to the utilization of technology to enhance financial services and products. The terms “financial” and “technology” are combined. Fintech encompasses a variety of technologies, such as mobile applications and software, that facilitate the digital management of finances for both individuals and enterprises.

Fintechs, the abbreviation for financial technology, are organizations that primarily depend on technology to perform the fundamental functions of financial services. These functions impact the way in which users store, save, borrow, invest, move, pay, and secure their money. The majority of fintechs were established after 2000, have been funded since 2010, and have not yet attained maturity. Money transfers between individuals, organizations, countries, and accounts are not only feasible but also effortless. A fintech company is not a typical entity; it can encompass a variety of entities, such as start-ups, growth companies, banks, nonbank financial institutions, and cross-sector firms. There are a variety of examples, including automated portfolio managers, stock- or cryptocurrency-trading applications like Robinhood and Coinbase, and peer-to-peer payment services like Venmo and Zelle.

Read: Top 10 FinTech Cybersecurity Challenges in 2025

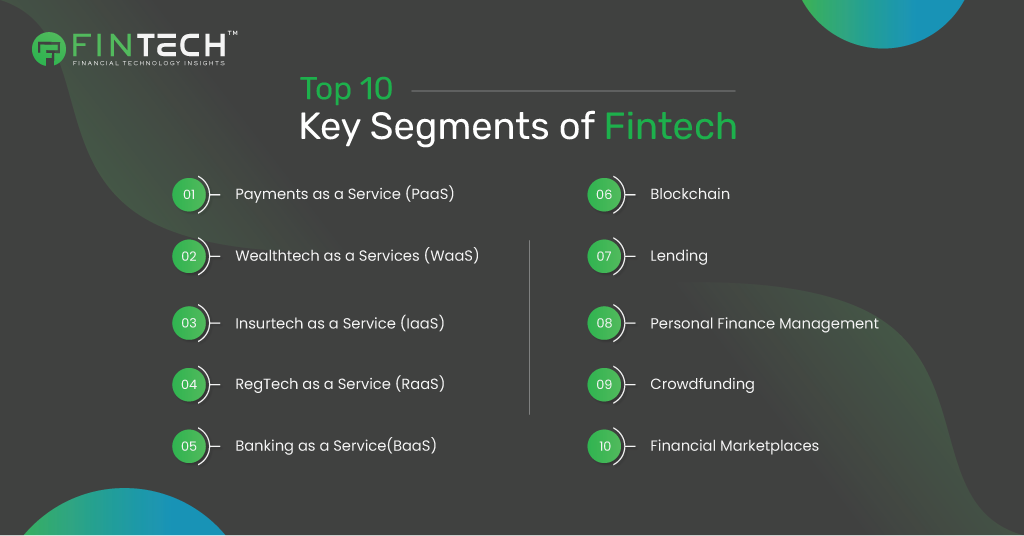

Top 10 Key Segments of Fintech

1# Payments as a Service (PaaS)

This segment includes mobile payment apps, online payment gateways, and contactless payment systems.Through an API gateway, service providers integrate their payment technology with a bank’s primary banking and digital banking system. Servers, networks, databases, operating system software, and development tools may be hosted at their data center. Amazon Web Services is the initial example of a PaaS company. This prominent PaaS company provides a diverse selection of cloud services. AWS is a cloud-based program that assists businesses in the development of solutions by means of integrated web services.Companies like PayPal and Square have revolutionized how we transact by allowing users to send and receive money digitally, whether through smartphones or online platforms.

2# Lending

Online lending platforms connect borrowers with lenders, bypassing traditional banks. Peer-to-peer lending and alternative credit scoring are popular in this segment. Companies like LendingClub and SoFi have made it easier for individuals and small businesses to access loans.Online lending platforms connect borrowers with lenders, circumventing traditional banks. Popular methods like peer-to-peer lending and alternative credit scoring enhance accessibility. Companies such as LendingClub and SoFi streamline the loan process, enabling individuals and small businesses to secure financing more easily. This innovation fosters financial inclusion and expands lending opportunities.

3# Wealth Management -Wealthtech as a Services (WaaS)

Robo-advisors and investment apps fall under this category. They provide automated investment advice and portfolio management based on algorithms. Companies like Betterment and Wealthfront help users grow their wealth without needing traditional financial advisors.The wealthtech sector’s expanding development has resulted in a more fundamental perspective among financial supporters regarding open doors. They are currently concentrating less on making wide bets across the industry and more on funding niche experts with unique business models that are perceived as being more significant, robust, and financially viable than those of their competitors. Blockchain.com has announced the acquisition of Independence, a Singapore-based exchange firm, and an advanced resource stage. Celera Markets, a resource the board corporation based in Hong Kong (SAR), China, was acquired by Golden Gathering. developed crossover abundance warning models that were specifically designed to provide innovation stages.White-label, embedded wealth, digital brokers, Robo retirement, and digital portfolio management Robo advisers are one of the most well-known segments of WealthTech enterprises.

4# Insurtech as a Service (IaaS)

This segment focuses on technology in the insurance industry. Insurtech companies use data analytics and machine learning to assess risks and improve customer service. Examples include Lemonade and Root Insurance, which offer unique and user-friendly insurance solutions.Players in this industry include Damco Group, DXC Technology Company, Quantemplate, Acko, Digit, and Easy Policy. These companies are expanding as the insurance market heats up due to an increase in insurance policyholders, though this industry did experience some slowdown during the global financial crisis. Innovative technologies are utilized by insurtech companies to create customer-focused insurance services and solutions, such as insurance comparison websites, employee group insurance plans, and digital insurance. Offering insurance infrastructure API, underwriting services, claims administration, customizing insurance products, and services pertaining to policy management systems can enable these services.

5# Blockchain

Blockchain technology enables secure, transparent transactions and is the foundation for cryptocurrencies like Bitcoin and Ethereum. Companies such as Coinbase and Binance facilitate cryptocurrency trading and offer wallets for digital assets.In a manner that is transparent, immutable, and resistant to manipulation, blockchain is a decentralized digital ledger that securely stores records across a network of computers. Data is contained within each “block,” which are connected in a chronological “chain.” The blockchain enables the secure and rapid execution of economic transactions in the banking sector, despite the potential for fraud and manipulation, as a result of the use of coding and encryption. This enables banking institutions to execute transactions with an increased level of security.

6# RegTech as a Service (RaaS)

Regulatory technology helps businesses comply with regulations more efficiently. This segment focuses on technology that streamlines compliance processes and reduces risks. Global regtech market participants include ACTICO GmbH, Broadridge Financial Solutions, Inc., Deloitte Touche Tohmatsu Limited, Jumio, MetricStream Inc., NICE, PwC, and Thomson Reuters. Financial institutions (FIs) are encouraged to consider regtech as an instrument to improve operational efficiency and regulatory compliance through RegTech as a Service (RaaS). a subgroup of fintech that concentrates on the development of technologies that could more effectively and realistically fulfill administrative requirements than current capabilities. Regulatory innovation companies implement innovation to facilitate client conformance, thereby reducing opposition and streamlining client onboarding procedures. RegTech companies offer a variety of services, including KYC and ID checks, charge consistency, computerized onboarding, AML consistency, misrepresentation discovery tools, and risk management devices and software. These services ensure that executives are aware of the administrative requirements and can easily comply with them. ClearTax, EaseMyGST, and Khata Book are at the forefront of the RegTech sector by offering a variety of consistency-related administrations.

7 #Personal Finance Management

These apps assist users in managing their finances, budgeting, and tracking expenses. Mint and YNAB (You Need A Budget) are popular choices that help individuals take control of their financial lives.The process of personal finance management involves the planning and budgeting of how one’s money is conserved or spent. Managing one’s personal finances entails the establishment of financial objectives, such as retirement savings, and the diligent pursuit of these objectives. Determining one’s long-term objective is the initial phase of financial management.

8# Banking as a Service(BaaS)

Digital-only banks that operate without physical branches are called neobanks. They offer banking services primarily through mobile apps. Examples include Chime and N26, which provide users with simplified banking experiences. Non-traditional businesses (often Fintechs) that provide banking services and products digitally through third-party distributors are referred to as “banking-as-a-service.” In 2020, the global BaaS market was estimated to be $2.41 billion in size. It is expected to grow by 17.1% annually to reach $11.34 billion by 2030. Banking as a service allows third-party organizations to utilize existing financial services by utilizing APIs that connect banks and external parties. These APIs allow non-financial enterprises, programmers, developers, and fintech organizations to access specific banking services.It also expands its reach to non-banking enterprises that wish to provide their clients with banking offices in conjunction with their product offerings. It establishes a unified platform to facilitate a more efficient and convenient access point to financial services. For example, an e-commerce website’s checkout page may provide immediate lending services in addition to a diverse array of payment options, including BNPL. BaaS will reinforce the ecosystem of a general finance product, which is being developed by banks in collaboration with fintech firms to innovate financial services. The future of Fintech is significantly influenced by the development of BaaS and its associated products and services in this approach. It has been significantly affected by the emerging concepts of digital transformation and mobile-first.

9# Crowdfunding

This segment allows individuals or businesses to raise funds from a large number of people, usually through online platforms. Websites like Kickstarter and Indiegogo help creators finance their projects while providing backers with rewards or equity.The process of crowdfunding involves the collection of funds to support the financing of initiatives and businesses. It allows fundraisers to collect funds from a large number of individuals through online platforms. The most common application of crowdfunding is by startups or expanding businesses to obtain alternative funding.

10# Financial Marketplaces

These platforms connect consumers with various financial products and services, including loans, insurance, and investments. Companies like NerdWallet and Bankrate help users compare and choose the best financial options for their needs.

Read: Top 10 Strategies for Effective Fintech Branding

Top 10 Fintech Companies

Founded in 1998, PayPal revolutionized online payments. It allows individuals and businesses to make and receive payments securely over the internet. With over 400 million active accounts, PayPal remains a leader in digital payments.

Founded by Jack Dorsey and Jim McKelvey in 2009, Square provides tools for businesses to accept card payments through mobile devices. Square has expanded its services to include payroll, loans, and e-commerce solutions.

Launched in 2007, LendingClub pioneered peer-to-peer lending, connecting borrowers with investors. It offers personal loans, business loans, and auto refinancing, helping millions access affordable credit.

Founded in 2013, Robinhood disrupted the brokerage industry by offering commission-free trading. It appeals to younger investors with its user-friendly app and has become a significant player in the stock trading space.

Read: Top 10 CIOs of The Fintech Industry

Founded in 2010, Stripe provides payment processing software and APIs for online businesses. It simplifies online payments, enabling companies to accept payments globally and manage subscriptions.

Established in 2012, Coinbase is a leading cryptocurrency exchange. It allows users to buy, sell, and store cryptocurrencies like Bitcoin and Ethereum. Coinbase has played a crucial role in popularizing cryptocurrency among mainstream investors.

Founded in 2010, Betterment is a robo-advisor that offers automated investment management. It provides personalized investment advice based on users’ financial goals, helping them build wealth over time.

Launched in 2015, Lemonade uses AI to provide renters and homeowners insurance. Its unique business model aims to minimize fraud and provide a fast, transparent claims process.

Founded in 2013, Chime is a neobank that offers fee-free banking services through a mobile app. It emphasizes financial wellness, helping users save and manage their money more effectively.

Founded in 2011, SoFi offers a range of financial products, including student and personal loans, investment management, and insurance. Its mission is to help members achieve financial independence.

Read: Fintech Marketing: Top 10 Power Strategies to Accelerate Growth

Read: Top 10 Strategies for Effective Fintech Branding

Thanks for reading!

To share your insights with the FinTech Newsroom, please write to us at news@intentamplify.com