What Are Digital Savings Platforms?

Digital savings platforms represent programs that are accessible and applicable both online and on a mobile device, with the other hand, facilitating people to save money in an accessible, automatic, and often goal-oriented manner.

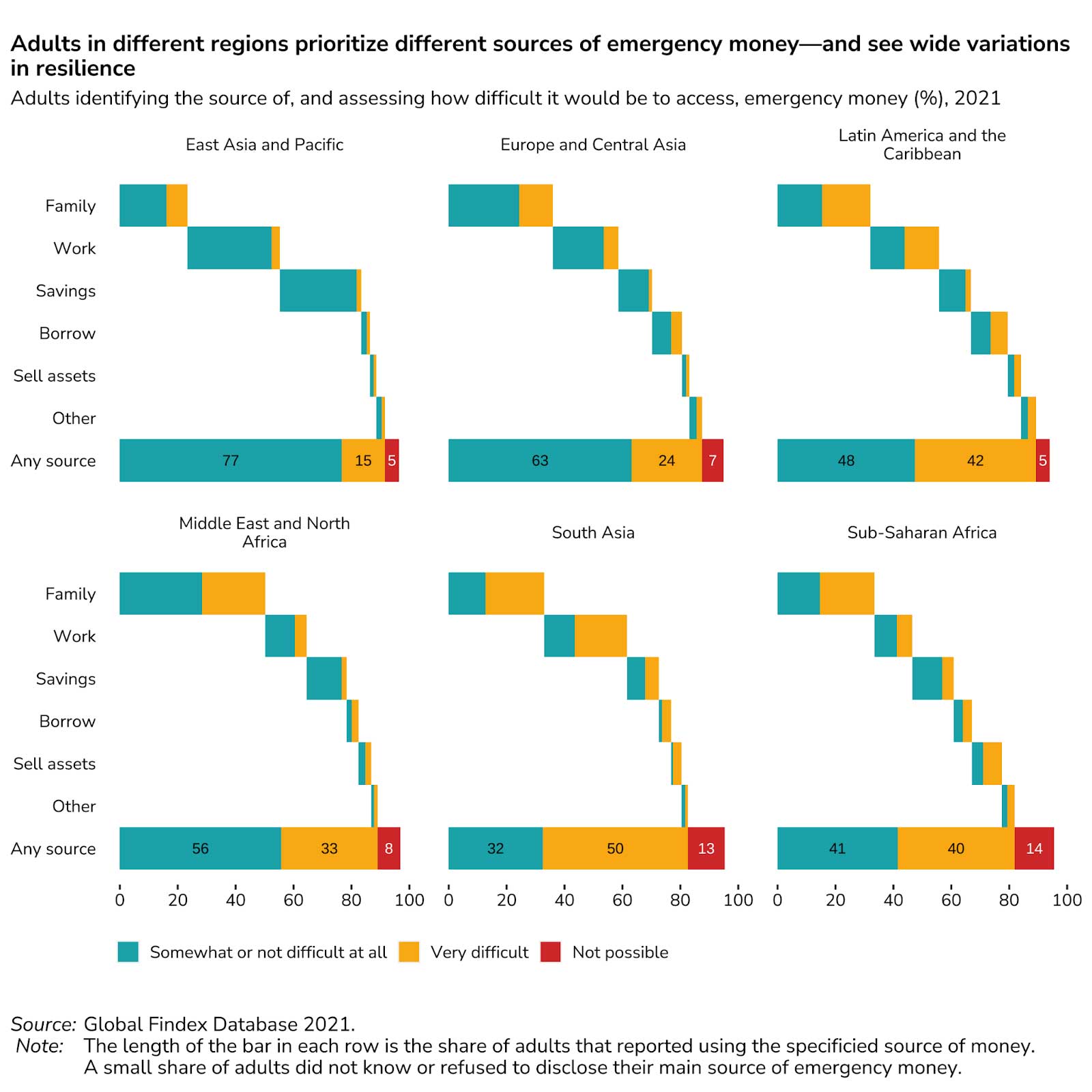

From the Global Findex, sadly only 55% of adults can reliably access emergency money.

It utilizes the technology, providing clients with user-friendly interfaces, and suggesting personalization and tools for efficient administration of savings. These platforms are specifically designed to help a wide array of users in terms of what they are actually looking for-the in basic savings accounts and those that are specifically after certain savings goals or investment avenues.

The Top 10 AI Books Every Business Leader Should Read in 2024

Types of Digital Savings Platforms

- Standalone Savings Apps: Digit, Acorns which basically focuses on automation, micro-savings, and round-up features.

- Neo-Banking Platforms: Chime, N26 which offer savings tools alongside digital banking services.

- Fintech-Driven Solutions: Wealthfront, Betterment which combine savings with investment opportunities.

- Prize-Linked Savings: Yotta, SaveUp which reward users with lottery-like incentives for saving money.

Fintech Platforms and Automated Micro-Savings Tools

Automated micro-saving tools are financial technologies designed to help consumers save money in a more convenient manner. They function by automatically sending small, frequent payments to a savings account or investment vehicle. One of the reasons why these tools are now gaining popularity is that they are easy to use, inexpensive, and can be easily included in regular financial habits.

Popular Automated Micro-Savings Tools

- Acorns: Invests the sum in diversified portfolios and concentrates on round-up savings.

- Qapital: Offers goal-based saving with customizable rules like round-ups or saving when you avoid spending triggers.

- Chime: Includes automatic savings features with no fees.

- Betterment: Savings automation and good investment options for growth in the long-term.

- Yotta: Combines saving with prize-linked incentives.

How Automated Micro-Savings Tools Work

- Round-Up Savings: It helps to round up one’s everyday transactions to the nearest currency and deposit the difference into a savings account. For example, if you spend $9.50, $0.50 is automatically saved.

- Scheduled Transfers: Anyone can set a daily, weekly, or monthly recurring transfer schedule for a small amount to be moved from their checking to their savings account.

- Goal-Based Savings: Such tools allow anyone to set specific savings goals, after which the app automatically saves the process to ensure targets are met.

- AI-Driven Insights: Such tools analyze the spending pattern and dynamically adjust savings contributions based on what the user can afford.

- Incentive-Based Savings: These apps reward users to achieve savings milestones or maintain consistent saving habits.

The Role Of Gamification And Behavioral Finance In Promoting Savings Habits In Underserved Communities

The economic constraints, limited financial literacy, and lack of access to traditional banking often impede the promotion of savings habits in marginalized communities, which is a critical challenge. Gamification and behavioral finance offer innovative solutions that make saving money engaging, accessible, and actionable by integrating human psychology and technology.

Top 15 Tax Software Solutions For 2024

Behavioral Finance: Key Principles

- Present Bias: Individuals prioritize immediate satisfaction over long-term advantages. One potential solution is to automate savings and provide immediate rewards.

- Loss Aversion: Fear of losing money discourages risk-taking, even for savings. Tools that guarantee small gains over time can address this.

- Mental Accounting: Individuals assign different functions to money. Digital wallets with labeled savings categories (e.g., “Emergency Fund”) encourage goal-oriented saving.

- Social Proof: Seeing peers save motivates similar behavior.

Gamification and Savings

- Challenges and Rewards:

- Daily or weekly savings goals with small incentives.

- Rewards for milestones like consistent deposits or reaching a target.

- Progress Tracking:

- Visual dashboards (e.g., progress bars or charts) that show growth over time.

- Leaderboards and Social Features:

- Friendly competition among users or communities to achieve savings goals.

- Micro-Wins:

- Celebrating small savings achievements to maintain momentum.

Gamification and behavioral finance bridge financial literacy and action, enabling underserved communities to make savings an achievable goal. By addressing psychological barriers and leveraging engaging tools, these strategies empower individuals to achieve financial security and independence.

Conclusion

Through the integration of technology, automation, and behavioral finance, digital savings platforms are the driving force behind a change in the way individuals approach saving. Users are given the ability to achieve financial stability and long-term wealth-building through these tools, making saving simple, meaningful, and efficient.

Fintech Insights: Top 10 CTOs Of The Fintech Industry

To participate in our interviews, please write to us at news@intentamplify.com

Top Fintech Stories: