Let’s discuss the Role of Open Banking in Driving Financial Inclusion. How open banking is enabling more innovative financial products that cater to underserved or unbanked populations. The potential of API-driven solutions to improve access to financial services, especially in regions with low banking penetration.

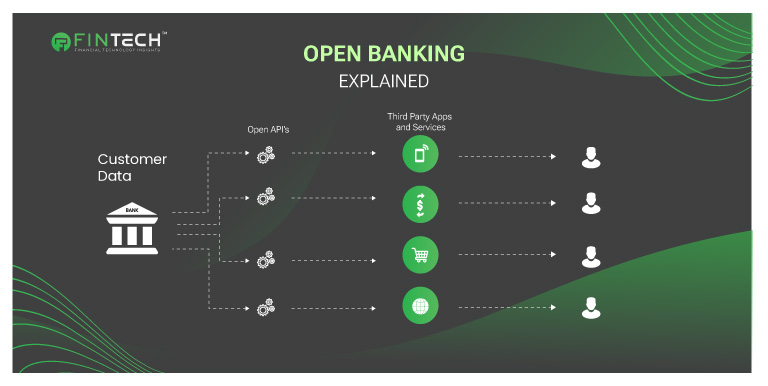

What is Open Banking?

It has the potential to offer individuals more convenient methods of managing and viewing their finances and simplified methods of accessing credit. Open banking can also power various payment services, including payments in video games and business accounting applications.

The practice already contributes to expanding financial services for millions of individuals and is building upon the broader introduction of real-time payments and other emerging payment technologies. Open banking is already revolutionizing financial services, and it has the potential to disrupt traditional financial services providers as more specialized and targeted offerings are brought online.

It ensures that consumers and small businesses are in control of the use of their financial data, allowing them to benefit from it through increased choice in the ways they pay, manage their money, access credit, and more. However, even though many of us are already utilizing and benefiting from open banking services, a few individuals are aware of the underlying mechanisms and the significance of this. Therefore, precisely what is it?

How Does It Function?

- Consumers are granted consent to share their financial data with other institutions.

- Third-party developers employ APIs to gain access to the data.

- The data can be utilized to enhance consumer experiences, develop new services, and more.

Advantages Of Transparent Banking

- Enhanced control: Consumers may have greater autonomy regarding their financial information.

- New services: A broader selection of financial services is available to consumers.

- Quicker applications: Lenders can make lending decisions more quickly without manually verifying documents.

- Services that are customized: Financial service providers can develop products and services that are more tailored to the individual.

- Enhanced financial management: Consumers can monitor their expenditures and oversee their financial affairs.

Top 15 Tax Software Solutions For 2024

Open Banking And Financial Inclusion Examples

First and foremost, what is financial inclusion and why is it significant?

Financial inclusion, as defined by the World Bank, is the provision of financial products and services that are both affordable and useful to individuals and businesses and that are delivered responsibly and sustainably.

7 of the 17 Sustainable Development Goals established by the United Nations have been identified as being enabled by financial inclusion, which is of paramount importance. It contributes to the reduction of poverty and inequality in addition to establishing a foundation for economic development.

Can Open Banking Grow Financial Inclusion?

Open banking can increase financial inclusion by providing digital financial tools to a broader audience. This includes small loans and credit for individuals and enterprises previously unable to access these services.

People with scant or no credit histories, such as retirees without debt or new immigrants, are at a higher risk of being rejected for new loans. Look no further. This is because lenders typically require credit reports that contain current information. By providing lenders access to your payroll data, your history of regular rent payments, or your overall cash flow, open banking can address this issue by enabling individuals to demonstrate their creditworthiness in various ways.

Open Banking: Driving Innovation In Financial Products For Underserved And Unbanked Populations

- Lack of Documentation: Many unbanked individuals lack the formal identification to open bank accounts.

- Geographic Limitations: Rural and remote areas often lack access to traditional banking infrastructure.

- Cost Concerns: High fees associated with banking services deter low-income individuals.

- Trust Deficit: Limited trust in financial institutions prevents engagement.

Innovative Solutions Driving Inclusion

- Digital Wallets and Payment Platforms: Seamlessly integrate with bank accounts, enabling users to perform transactions, save, and invest.

- Microlending Platforms: Leverage alternative data sources for credit scoring, offering loans to those previously excluded from credit markets.

- Savings and Investment Tools: Encourage savings through gamification, automated micro-investing, and goal-based financial planning.

- Remittance Services: Reduce cross-border transaction costs and improve remittance speed and security.

The Potential Of API-Driven Solutions In Regions With Low Banking Penetration

API-driven solutions hold transformative potential in regions with low banking penetration, offering innovative ways to overcome traditional banking barriers. By leveraging APIs, financial service providers can:

- Mobile Banking for Everyone

APIs enable banking services to integrate seamlessly with mobile platforms, allowing people to access essential financial tools through smartphones. This is especially valuable in areas where physical bank branches are scarce or nonexistent, empowering users with economic independence. - Real-Time Payments and Transactions

One of the most significant advantages of APIs is their ability to enable instant payments and remittances. By facilitating real-time transactions, APIs reduce reliance on cash, making financial participation more inclusive and secure. People can send or receive money instantly, whether for personal needs or business purposes. - Banking in Everyday Apps

APIs allow financial services to be embedded into non-financial applications, such as e-commerce platforms, ride-hailing apps, or agricultural tools. For example, farmers can access microloans through apps they use for crop management, or shoppers can access credit while purchasing items online. This integration makes banking a natural part of daily activities, reaching people where they are. - Scalable and Tailored Solutions

API-driven systems are highly adaptable. Developers can build modular financial products that cater to the specific needs of local communities. As demand grows, these solutions can quickly scale up to accommodate larger populations without requiring significant infrastructure investments.

Conclusion

The emergence of open banking is causing a significant transformation in the financial sector. Open banking promotes innovation, improves the consumer experience, and provides financial services to populations that have been historically underserved or unbanked by allowing third-party providers access to financial data through secure application programming interfaces (APIS). As the global unbanked population—approximately 1.4 billion—continues to challenge financial inclusion, open banking has emerged as a critical solution.

Open banking is a transformative force in the financial sector, unlocking unprecedented opportunities for underserved and unbanked populations. By leveraging technology, innovation, and collaboration, it has the potential to bridge gaps in financial inclusion, offering millions a pathway to economic empowerment. As the financial ecosystem continues to evolve, open banking’s role in shaping an inclusive future cannot be overstated.

Fintech Insights: Top 10 CTOs Of The Fintech Industry

To participate in our interviews, please write to us at news@intentamplify.com

Top Fintech Stories: